Budget 2021 Malaysia Tax

Delivers the 2022 budget speech at parliament in Kuala Lumpur Malaysia Friday Oct. The Minister of Finance tabled the 2021 Budget in the Parliament of Malaysia on 6 November 2020.

Pin On Economies And Governments

Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz said the government wants to encourage people to buy these vehicles and their long-term plan is to make Malaysia carbon neutral by 2050.

Budget 2021 malaysia tax. It is proposed that the resident individual tax rate be reduced by 1 from 14 to 13 for the chargeable income band RM50001 to RM70000. EVs in Malaysia to be completely tax free soon zero import and excise duties free road tax. The following is the summary of tax measures for Malaysia Budget 2021.

The honourable Minister of Finance YB Dato Sri Tengku Zafrul bin Tengku Abdul Aziz tabled the 2021 Budget on 6 November 2020 which was followed by the release of the Finance Bill 2020. 1 day agoBudget 2022. 22 hours agoIn this photo released by Malaysias Department of Information Malaysias Prime Minister Ismail Sabri Yaakob delivers the 2022 budget speech at parliament in Kuala Lumpur Malaysia.

22 hours agoMalaysias government is proposing a record budget for 2022 to bolster an economic recovery following the coronavirus pandemic with industrial incentives and. Malaysias Minister of Finance MOF presented the 2021 Budget proposals on 6 November 2020 announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50001 to MYR 70000. Malaysias government has proposed record spending for 2022 to bolster post-pandemic economic recovery with.

The following proposals related to indirect taxes were included in the Budget. In Cars Hybrids EVs and Alternative Fuel Local News By Gerard Lye 29 October. Apart from the above tax incentives strategic investments by such companies may be considered for other facilities including grants.

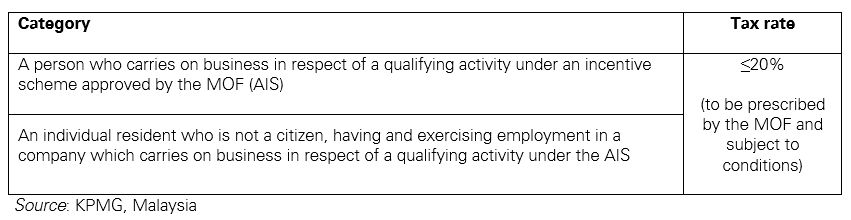

TaXavvy Budget 2021 Edition - Part 1 8. Malaysia the Budget 2021 proposes that the following tax incentives be given. 22 hours agoIn this photo released by Malaysias Department of Information Malaysias Prime Minister Ismail Sabri Yaakob center and Finance Minister Zafrul Aziz second from left walk together to delivers the 2022 budget speech at parliament in Kuala Lumpur Malaysia Friday Oct.

Reduction of individual income tax rate. The tax highlights of Budget 2021 include. Malaysia Tax Budget Conference 2022.

Income tax rate of 0 up to 10 for the first 10 years and Income tax rate of 10 for the subsequent period of 10 years. Income tax rate for resident individuals be reduced by 1 from 14 to 13 for the chargeable income band of RM50001 to RM70000 from YA 2021. Chargeable Income RM Current Tax Rates 2021 Tax Rates 05000 0 0 500120000 1 1 Global InSight Only see possible.

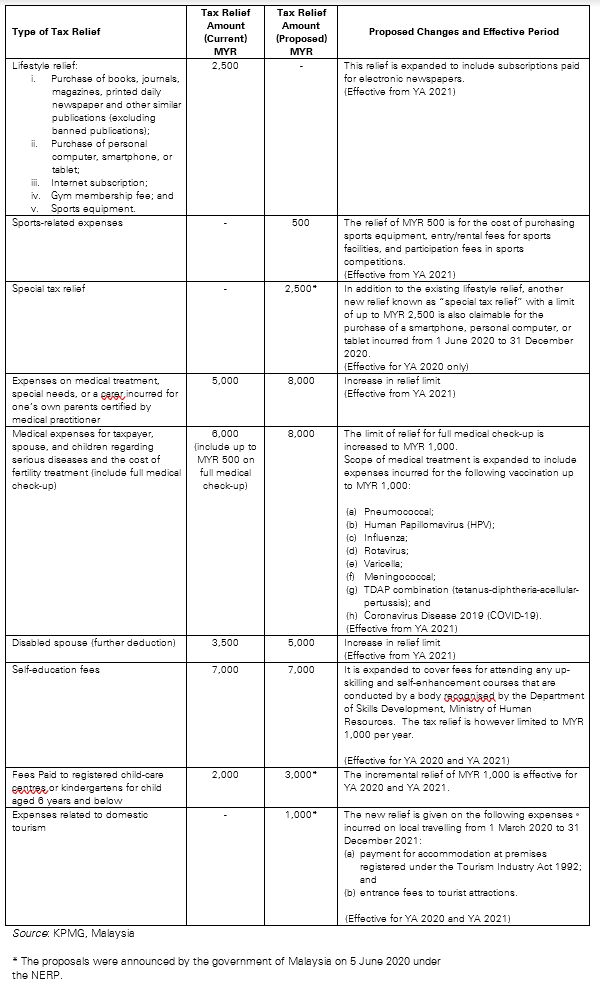

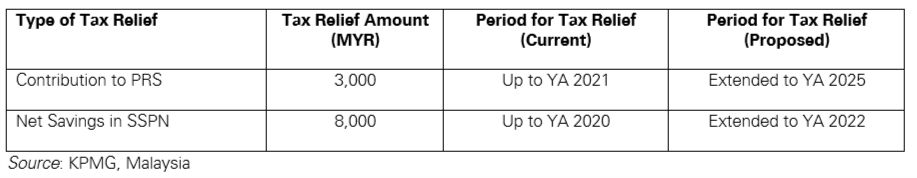

Current economic situation the 2021 budget proposes that the tax rate for this chargeable income band to be reduced by 1 percentage point. The proposed national Budget for the year 2021 contained a number of interesting income tax initiatives that you should be aware about. 1 There is also an increase an extension and an expansion of the scope of tax reliefs this includes the amendment in Finance.

Although the tax saved is only RM200 it does help when households are grappling with the economic fallout from Covid-19. According to the Finance Ministry the proposal will benefit 14 million taxpayers in the country. The tax rate will be reduced from 14 to 13 for the year of assessment 2021.

They told Malay Mail that imposing the added tax on companies might prompt the affected companies to increase prices for consumers. He also announced a 100 road tax exemption for EVs. 22 hours agoMalaysia plans windfall tax for rich companies in new budget.

Here weve unpacked the Budgets key proposals and highlights out of the Finance Bill to provide insights and analyses useful to you and. 5 hours agoKUALA LUMPUR OCT 30 The governments proposal to impose a one-off surtax on corporations with over RM100 million in chargeable income under Budget 2022 could have long-term ramifications said economists. Malaysia Tax Measures Affecting Individuals in Budget 2021.

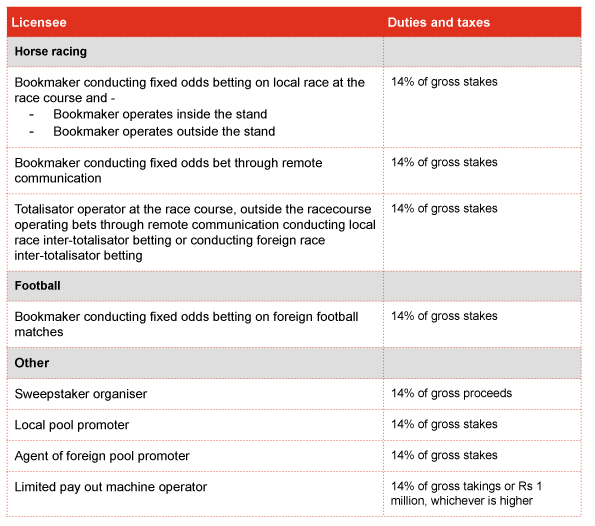

Imposition of Sales Tax on the importation of cigarettes with drawback facilities for re-export. Non-resident individuals tax rate remains at a flat rate of 30. Reduction in personal income tax rate by one percentage point for tax resident individuals for chargeable income in the band of RM50001 to RM70000 Preferential 15 personal tax rate for non-Malaysian citizens holding key positions in.

Relief on expenses for medical treatment special needs and parental care to be increased from RM5000 to RM8000. From expanded medical tax reliefs to an anticipated income tax reduction here are the personal income tax highlights from Budget 2021. It is proposed that the resident individual tax rate be reduced by 1 from 14 to 13 for the chargeable income band RM50001 to RM70000.

23 hours agoKUALA LUMPUR Oct 29 Electronic car enthusiasts or those wishing to buy one will now get tax exemption as part of Budget 2022 incentives. It has been close to one and a half years since Malaysia went into MCO on 18th March 2020. 22 hours agoMalaysia plans windfall tax for rich companies in new budget.

With a total of RM3225bil allocated Budget 2021 is the biggest ever in the countrys history in a bid to boost economic resilience safeguard the wellbeing of the Rakyat and reinforce healthcare in the nations path to recovery. 22 hours agoMalaysias government is proposing a record budget for 2022 to bolster an economic recovery following the coronavirus pandemic with industrial incentives and. A Roadmap for Recovery.

Taxavvy Budget 2021 Edition Part 2

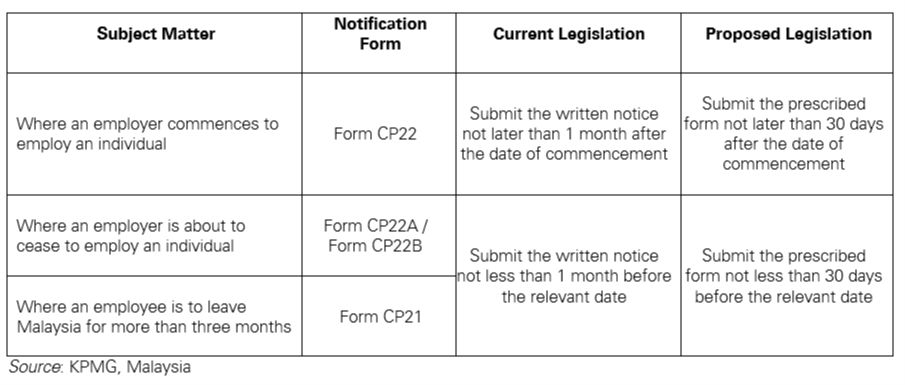

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

Free Monthly Budget Template Cute Design In Excel Monthly Budget Template Household Budget Template Budgeting Worksheets

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

8 Oct 2020 Heineken Brewery Glass Of Milk

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2021 Homage Malaysia

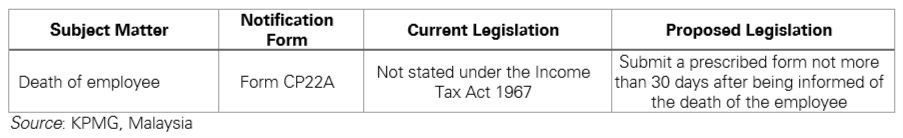

Budget 2021 2022 Taxation Pwc Mauritius

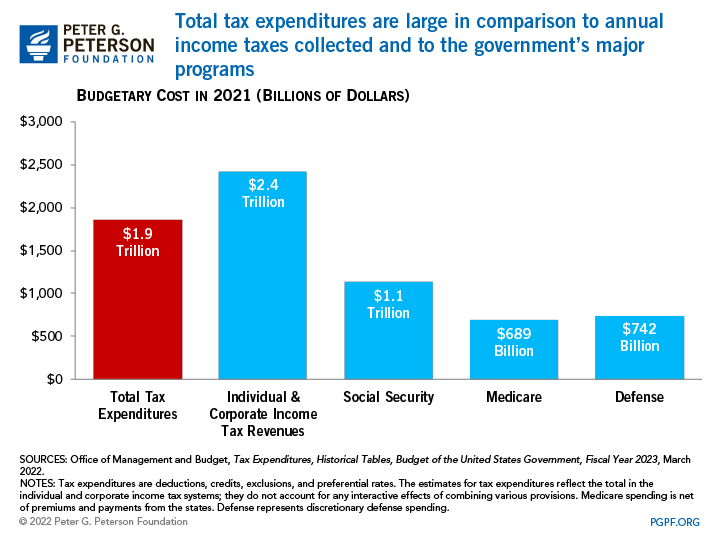

Understanding The Budget Revenues

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

Understanding The Budget Revenues

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global